Balancing books with Accounts Payable

STRATEGY . DISCOVERY . RESEARCH . TESTING . VISUAL DESIGN

SUMMARY

Executive Snapshot

Small business owners using FreshBooks faced difficulties managing outgoing cash flow because there was no integrated Accounts Payable (A/P) solution. This led to lost opportunities, increased support requests, and limited oversight of payables.

Through a thorough UX initiative that involved research, design, prototyping, and iterative improvements, we implemented a comprehensive A/P feature set that includes bill management, vendor relationship management, reconciliation workflows, and in-depth reporting.

Launched in December 2020, this feature quickly gained traction, with more than 1,100 systems adopting it within 60 days and processing $19.3 million in bills, resulting in significant subscription upgrades.

Key takeaways emphasize the crucial role of clear mental distinctions (Bills vs. Expenses), proactive reconciliation processes, and targeted in-app messaging to boost adoption.

My Role

In my role as Senior Product Designer, I defined and guided the UX strategy for A/P from discovery through to delivery. I conducted extensive user research, synthesized the insights, and worked closely with Product Management, Engineering, Marketing, and Customer Support teams.

Additionally, I mentored and supervised junior UX designers on the project, facilitating cross-team alignment through workshops and stakeholder sessions.

Team Structure

The Alchemy Squad consisted of a Product Manager, two Product Designers (including myself as the lead), five Developers (initially scoped), a UX Research Subject Matter Expert (SME), a Content Design SME, and a QA and Engineering Manager.

I facilitated collaboration among these roles to maintain focus on user-centric objectives and the product vision.

CUSTOMER LENS

The problem our customers faced

FreshBooks has historically lacked comprehensive accounts payable management, forcing users to estimate bills as expenses or turn to external software. This critical gap resulted in:

- 45% of sales leads are being lost among scaling users over seven months.

- Over 300 customer support tickets have specifically requested an accounts payable (A/P) solution.

- Incomplete and inaccurate cash flow reporting has been affecting business decisions.

- Duplicate accounting entries for vendor bill payments and expenses are due to bank reconciliation.

These challenges underscored an urgent need to transform FreshBooks into a comprehensive accrual-based accounting solution, focusing on effective management of vendor payments, tracking due dates, and integrating payments seamlessly into the platform.

TARGET USERS AND AUDIENCE INSIGHTS

Who is this being built for?

Our primary users were small to medium-sized businesses, specifically those in the Full-Timers and Scaling segments, seeking to expand their operations. These entrepreneurs interact with multiple vendors and maintain relationships with contractors, accountants, lawyers, and consultants. Due to the complexity of these relationships, users required robust vendor management capabilities, including the ability to track vendor contact information, manage tax compliance (such as 1099 statuses), and monitor payment histories.

These business owners depended on precise cash flow management and forecasting because of unpredictable client payments, making clear visibility into future financial obligations and accurate payment tracking essential. Common challenges included repetitive manual data entry, inefficient reconciliation of duplicate transactions in automated bank feeds, and inadequate visibility into financial commitments.

By identifying and understanding these user profiles, we tailored our A/P solution to address their critical pain points, streamline financial operations, and significantly reduce bookkeeping errors, instilling a sense of security and confidence in the A/P solution.

DISCOVERY

Conducting Generative and Evaluative Research

Our research and discovery efforts were designed to provide a comprehensive understanding of our users, market gaps, and strategic opportunities. We integrated internal data analysis, qualitative user insights, quantitative surveys, competitive assessments, and targeted assumption testing to inform our approach.

Internal Research & Stakeholder Insights

We began our research by examining internal data sources, including sales feedback, customer support tickets, and direct input from accountants and business owners.

Lost Sales Leads highlighted the critical business impact:

- A significant number of leads explicitly cited the absence of Accounts Payable as a reason not to adopt FreshBooks, highlighting its perceived necessity compared to competitors like QuickBooks and Bill.com.

- Users expressed clear dissatisfaction with external workarounds, stating that A/P was a fundamental, non-negotiable requirement for their workflows.

Support tickets consistently highlighted the need for comprehensive AP functionality:

- Frequent requests included bill management, payment reminders, integrated bank payments, vendor management, and reporting capabilities such as balance sheets and accounts payable aging reports.

- Users expected a streamlined experience, expressing frustration with the manual overhead of tracking expenses separately from accounts payable, and explicitly sought automated solutions like email forwarding for bills, OCR integration, and seamless electronic payments.

Competitive & Market Analysis

We conducted detailed competitive benchmarking against leading market solutions, including QuickBooks, Xero, Wave, and Bill.com

- Competitors clearly distinguished "Bills" and "Expenses" and provided robust reconciliation workflows to avoid duplicate bookkeeping entries.

- Automation through OCR and email integrations was becoming baseline rather than advanced functionality.

Qualitative Research

Extensive qualitative research, including in-depth user interviews and observational sessions, yielded critical behavioural and contextual insights:

- Users universally viewed all bills as expenses but clearly differentiated between paid and unpaid statuses. This distinction was pivotal in assisting users with managing their cash flow and effectively forecasting business finances.

- Recurring subscriptions represented predictable yet often overlooked expenses that required systematic tracking and proactive management.

- Contractor invoices created unique anxieties due to their larger amounts and dependence on timely client payments.

Quotes from particpants

“I wish it was all in one place instead of cobbled together from different sources.”

“I have missed a contractor payment...just because of busyness. Contractors often don’t remind you before the due date.”

“Subscriptions are the most important for my business. Staying on top of them is critical.”

Quantitative Research

We conducted a comprehensive survey (1,426 users), validating key assumptions and revealing clear themes:

- Users strongly valued tracking unpaid bills within FreshBooks, highlighting the need for a "single source of truth."

- Users found great benefits in integrating AP into their existing FreshBooks workflows.

- Users expressed a desire for integrated bill payments but emphasized that frictionless data entry and seamless integration were prerequisites for adoption.

- Contrary to expectations, "scaling" users did not universally experience greater difficulty managing cash flow than "full-time" users; AP management needs varied independently of company size.

PHASE 1

Design Strategy and MVP scoping

Based on extensive qualitative and quantitative research, we focused the MVP on three pillars.

Dual Entity Model & Modular Architecture

Expenses are designated for paid, one-off transactions. At the same time, Bills develop into a first-class, unpaid-until-paid entity with its own CRUD lifecycle, mirroring how users naturally perceive obligations as they come due. By isolating Bills, we can avoid massive backfills or migrations of historical expense data, reducing technical risk and accelerating delivery.

Seamless Data Entry & Automation

Continue to prioritize OCR/email forwarding to automatically populate Bill drafts (“forward invoices to FreshBooks”), addressing the main adoption barrier. Maintain our rule-based bank-feed matching as a corrective measure, but plan for intelligent, ML-driven reconciliation in the future.

Alerts and Forecasting

Expand reminder controls so users can choose the lead time for alerts on both bills and recurring charges. Lay the groundwork for a unified AR/AP cash-flow dashboard that reflects research indicating that owners want to see payables alongside receivables for precise forecasting.

MVP Scope - Phase 1

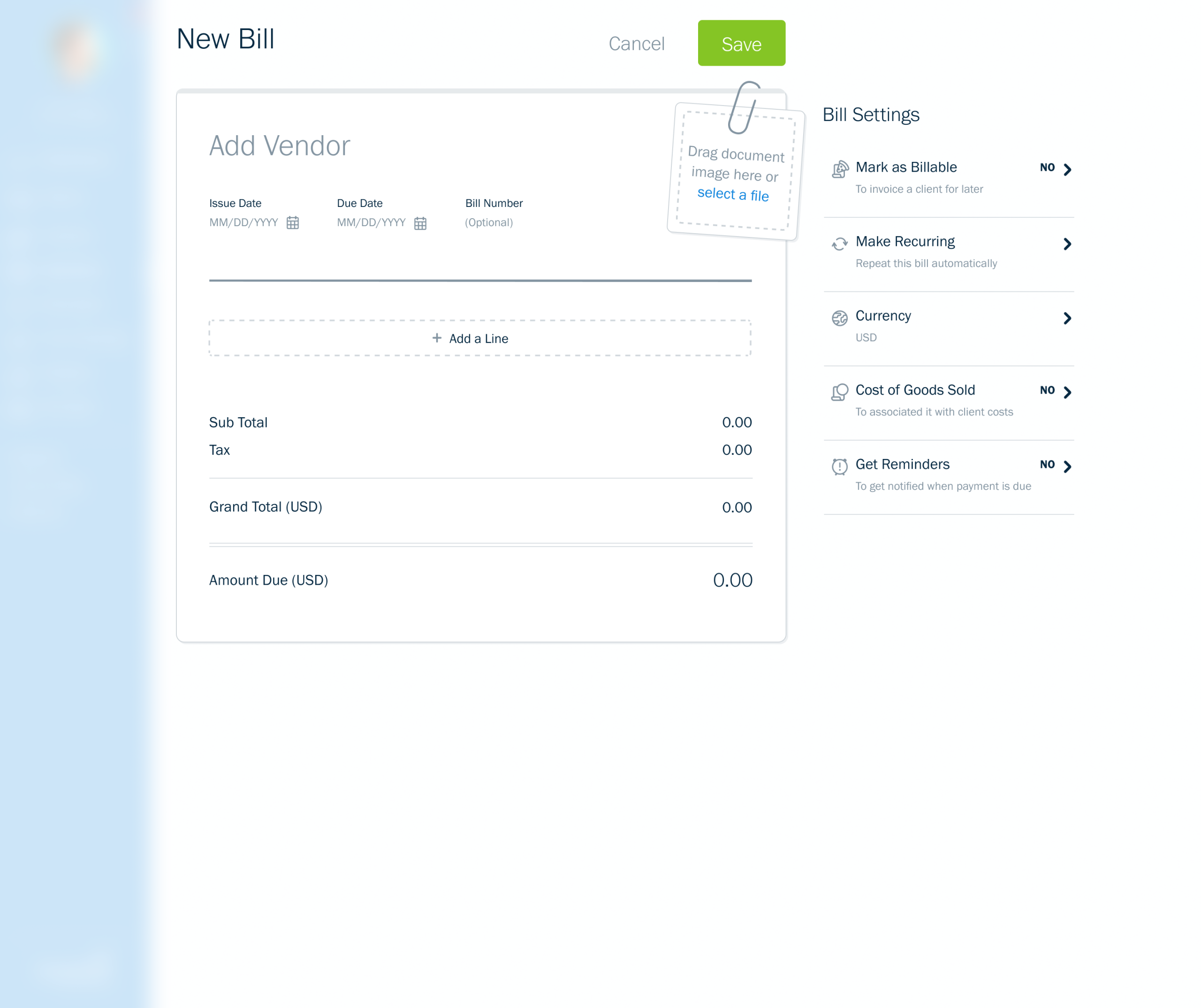

- Bill CRUD - Create/Edit/Delete Bills with mandatory Issue Date, Due Date, line items, tax calculations, and attachable vendor invoices.

- Bill Payment & Reconciliation - Record payments against Bills. Guided matching of bank-imported transactions flagged as potential bill payments.

- Dedicated Vendor Management - Lightweight Vendor directory (separate from Merchants), tracking contact details, 1099 status, and related Bills/Payments.

- Core AP Reporting - New “Unpaid Expenses” report and enhancements to Profit & Loss, Balance Sheet, and Cash-Flow Statement to account for unpaid liabilities.

ITERATIONS AND TESTING

Testing and Iterating on the core offering

To validate our solution and identify areas for improvement, we conducted a mixed moderated/unmoderated usability study with seven participants each (Five scaling business owners and two professional accountants) using the design system to create prototypes.

The test plan focused on core A/P workflows (Bill creation, Payment recording, Bank-feed reconciliation, and Reminder configuration) and assessed critical assumptions about mental models and feature discoverability.

Automation Is Non-Negotiable

Participants overwhelmingly preferred sending invoices through email or OCR capture rather than manual form entry. When prototype flows required typing in line items, users hesitated or skipped steps, citing time constraints.

Mental Model Alignment Requires Clear Guidance

Although our dual-entity approach (Bills vs. Expenses) aligned with most users’ thinking, a few testers initially attempted to use the Expenses tab for unpaid invoices. We added clear, contextual tooltips and onboarding banners to guide users into the Bills workflow.

Line Items Are “Nice-to-Have,” Not Mandatory

While accountants appreciated detailed line-item breakdowns, business owners found them cumbersome for everyday bills. They preferred a straightforward summary view with an option to delve into details.

Category & Tax Labels Need Simplification

Participants struggled with our terminology (“CoA” vs. “Category” and “Tax Code” labels). This confusion resulted in mis-categorization in the prototype.

Payment Actions Must Be Explicit

The distinction between “Record Payment” (for offline payments) and “Pay Online” (for future in-app payments) wasn’t immediately clear. Some users clicked the wrong action, leading to incorrect bill states.

SOLUTION AND EXECUTION

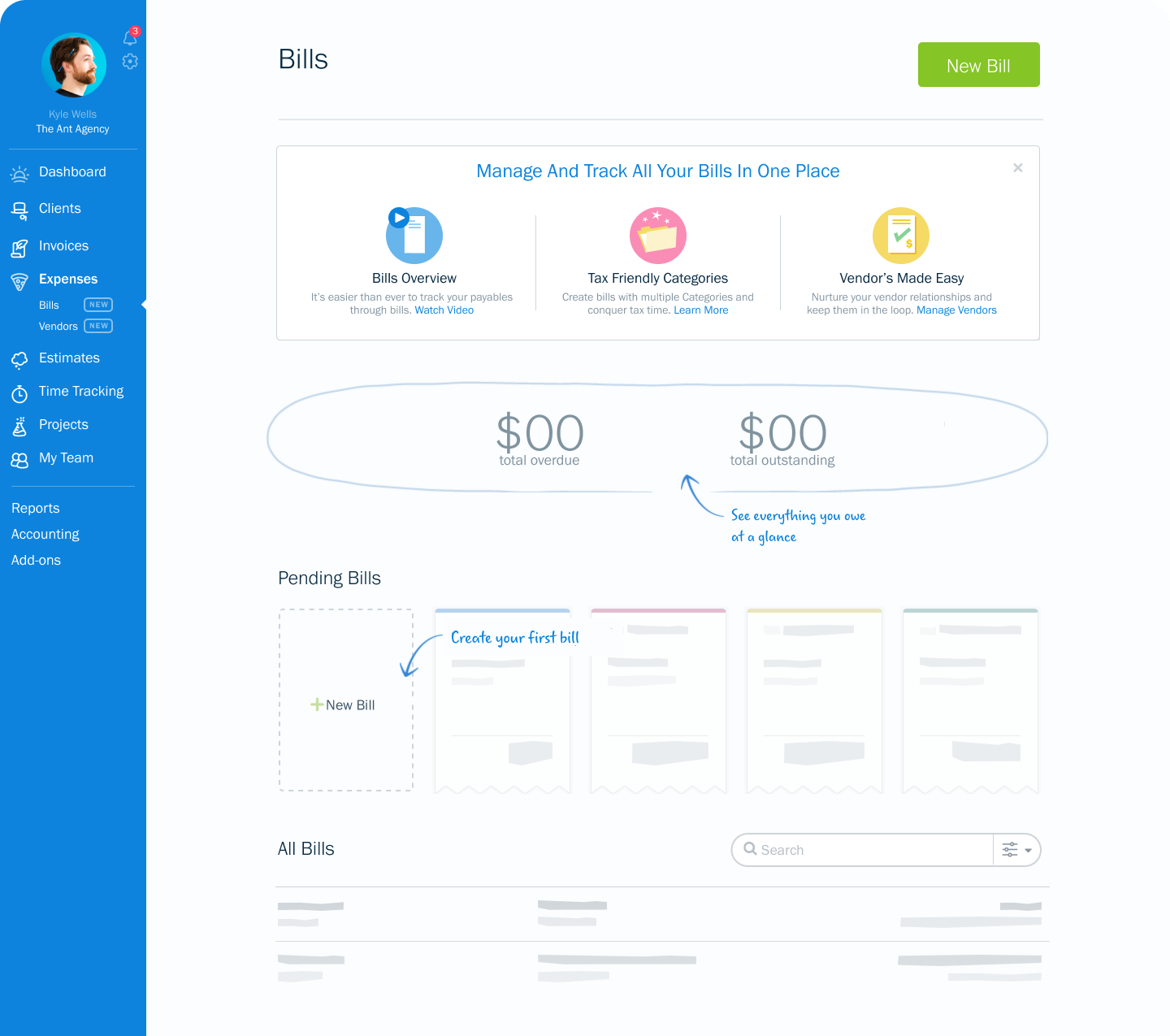

Bills CRUD & Lifecycle

We created a standalone section in the UI where users can view, filter, and manage all outstanding obligations.

Users can create and edit bills with line-item details (description, category, tax), a mandatory Issue Date and Due Date, and optional attachments (PDFs or images of vendor invoices).

Each bill transitions through Open → Overdue → Paid based on Due Date and the user-entered Paid Date, clearly reflecting the unpaid-expense mental model we validated in our research.

SOLUTION AND EXECUTION

Seamless Data Capture & Automation along with guided Reconciliation

Users forward vendor invoices to a unique FreshBooks email address. An OCR service extracts key data (vendor, amounts, dates) to pre-populate a draft bill, minimizing manual entry.

We enhanced the existing bank import flow with two rule-based criteria that flag imported transactions as potential bill payments (exact match or due-date proximity), ensuring accurate reconciliation without duplicate General Ledger entries.

Users either reconcile by deleting the imported expense and marking the bill as paid or dismiss the flag, keeping bookkeeping accurate.

SOLUTION AND EXECUTION

Vendor Management Separation

A lightweight CRUD interface for vendors, distinct from “merchant” contacts, enables owners to store the company name, contact information, and tax status (e.g., 1099 eligibility), as well as view all linked bills and payments.

Importing transactional merchants from the bank feed does not automatically create vendor records; users choose which contacts to promote to vendors.

SOLUTION AND EXECUTION

Enhanced Reporting & Visibility

A new report categorizes open bills into due-date buckets (Overdue, Due This Week, Due Next Month), allowing for quick prioritization.

The standard AP aging schedule (0–30, 31–60, 61+ days) is integrated into the reporting suite. Unpaid bills now show as current liabilities on the Balance Sheet, and the Cash Flow statement reflects both outgoing payments and upcoming obligations.

IMPACT AND OUTCOMES

Impact that increased revenue and satisfaction

Initial closed beta exceeded expectations

3% participation rate (200 of 6,400 invited users), higher than anticipated.

Users created 114 bills worth $88.5K USD within the first three weeks, confirming market fit and usability.

General Availability launch in December 2020

- Post-beta satisfaction rose from 3.2 to 4.3 out of 5

- Over 1,100 active systems within 60 days.

- 5,971 bills were created, totalling $19.3M in managed funds.

- A measurable decrease (80% reduction) in support tickets related to missing A/P functionality.

- Significant uplift in plan upgrades (107 new upgrades, 35 modifications from trial), directly attributing revenue growth to A/P functionality.

- Scaling businesses engaging with A/P features saw a 15% uplift in retention.

ROADMAP

Continuous Improvements

© Yash Bhatt. Designed with ♥ & powered by curiosity